|

|

|

Won't Fix Third World Debt |

|

Compiled by GayToday Courtesy of Worldwatch Institute

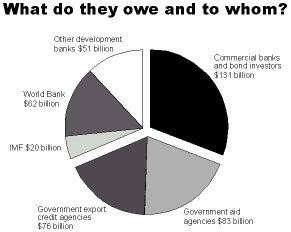

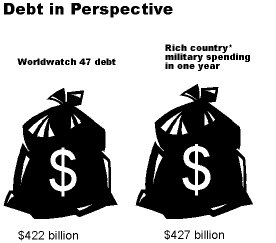

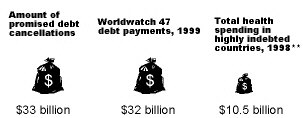

"Before officials congratulate themselves they need to pay attention to a wider problem-how to prevent this debt crisis from happening again," said David Malin Roodman, author of Still Waiting for the Jubilee: Pragmatic Solutions for the Third World Debt Crisis. "Hundreds of billions of dollars in unpayable loans still need to be written off. And creditors have done little to change the lending practices that created the debt problem in the first place." "For example, initiatives to cut debt in Tanzania from $5.7 billion to about $1.8 billion are welcome, but unless things change, the country will probably borrow enough to lift its debt back to $6 billion by 2018. It's not enough to clean up past mistakes. We also need to learn from them. 'Forgive and forget' is a recipe for more debt troubles." Roodman calls for major reforms to prevent poorer countries from sinking back into debt. On the borrower side, these include making governments less corrupt and more accountable. On the creditor side, the reforms include: Giving poor countries greater access to foreign exchange earnings by lowering trade barriers in rich countries to allow more imports from the poorest ones. Basing government contributions to the IMF and development banks on how well these lenders reform management culture to reward employees for results instead of loan-pushing. Ensuring that aid agencies, from the Japan International Cooperation Agency to the World Bank, lend less and grant more to the poorest nations. Scaling back or eliminating government export credit agencies in rich countries, which subsidize their exporters by lending money to nations that are buying the goods-even when those nations have no capacity to repay the loans. "Unfortunately, many official lenders seem trapped in a fortress mentality, so fearful of admitting their mistakes by openly canceling failed loans that they are prolonging the debt crisis," said Roodman. "In a sort of money merry-go-round, rich governments, the IMF, the World Bank, and other official lenders are granting poor countries new loans to repay old ones. For every dollar they lend to low-income nations they get 83 cents right back in principal and interest payments. This makes bad loans look good and hides the full extent of failure." Through the enhanced Debt Initiative for Heavily Indebted Poor Countries (HIPC initiative), announced at the 1999 G-7 summit in Cologne, official creditors took a step toward ending the debt crisis in 41 of the poorest nations, offering to cancel far more debt than they had before. "The HIPC initiative has some serious weaknesses," says Roodman. "To begin with HIPC excludes three of the world's largest debtor nations-Indonesia, Pakistan, and Nigeria-on the questionable ground that they have the capacity to repay their debt. But credit agencies such as Moody's and Standard and Poor's rate them less creditworthy than countries on the HIPC list. For a complete picture of the Third World debt crisis, Roodman argues including three additional high-debt countries-Cambodia, Afghanistan, and Comoros-that are not on the HIPC list. The amount of debt relief under HIPC is far too small. Of the 47 most heavily indebted countries, only 22 have received promises of debt relief under recent debt relief programs. These 47 countries are so mired in debt and poverty that roughly $291 billion can never be repaid of their $422 billion foreign debt, according to the report. And official lenders have so far promised to cancel only $33 billion, mostly through the HIPC initiative, including about $20 billion in the last year. "Critics understandably worry that canceling more debt is tantamount to writing blank checks to dictators. But lenders have already written those blank checks by making loans that now cannot be repaid. Writing off unpayable debt is merely responsible accounting." Today's unsustainable debt burdens are a formidable obstacle to poverty alleviation and environmental protection. Many of the 47 most indebted countries spend more on foreign debt service than on basic health, education, and social services for their own people. Thirty-seven of these countries rank in or just above the United Nations' lowest category of human development. In one extreme case, Zambia devoted 40 percent of its budget to foreign debt payments in 1997 and only 7 percent to basic social services. The death rate among Zambian children is rising, partly because a third of those under five have not received cheap, effective vaccines. Additionally, the need to generate foreign exchange in many highly indebted countries is placing an extra burden on natural resources. Debt pressure has spurred increases in export-oriented mining and logging in developing countries. Roodman says that several studies have found a statistical link between high debt burdens and deforestation. To bring the third world debt crisis to a quick close and prevent a repetition, Roodman recommends a four-step recovery program for governments and international lending agencies: 1. Acknowledge the reality that most of the debt will never be repaid. 2. Wipe the bad loans off the books. 3. Study the past to understand what caused the crisis and what changes are necessary to avoid repeating these mistakes. 4. Apply these lessons by reforming the international lending system. "Unfortunately we haven't even made it to step two yet," he said. Who are the Worldwatch 47?

|

|

Borrowing, debt

service, and

Foreign Borrowing

Foreign Debt

Spending on Basic Benin

$54.87

$20.63

$18.76 Bolivia

$110.00

$69.83

$118.72 Burkina Faso

$19.49

$9.64

$19.28 Cameroon

$3.99

$4.02

$0.45 Nicaragua

$46.43

$46.47

$29.88 Zambia

$11.36

$34.58

$6.05 |

|

Related Information: Read Worldwatch Paper 155 Still Waiting for the Jubilee Excerpt: Introduction (pages 5-11) Order Worldwatch Paper 155: Still Waiting for the Jubilee: Pragmatic Solutions for the Third World Debt Crisis. April 2001 Debate: "What Will Bring the Third World Debt Crisis to a Lasting End?" Download author's PowerPoint presentation (103KB) from What Will Bring the Third World Debt Crisis to a Lasting End? Listen to Audio files from What Will Bring the Third World Debt Crisis to a Lasting End? (coming soon). |

© 1997-2002 BEI

When the World Bank and International Monetary Fund spring meetings open in Washington, D.C., on April 29, 2001, officials will point proudly to the roughly $20 billion in debt that they have promised to cancel since their heavily-protested meetings last year. These promises take a step in the right direction, concludes a new report from the Worldwatch Institute, a Washington-based research organization. But even full cancellation would only be a Band-Aid for a broken system.

When the World Bank and International Monetary Fund spring meetings open in Washington, D.C., on April 29, 2001, officials will point proudly to the roughly $20 billion in debt that they have promised to cancel since their heavily-protested meetings last year. These promises take a step in the right direction, concludes a new report from the Worldwatch Institute, a Washington-based research organization. But even full cancellation would only be a Band-Aid for a broken system.